HWSim Full Version with Graphs (used for this post)

HWSim Case Study: Assume you are a Female, 5’-6”, 254 lb: losing 55 lb in 7 months.

Cheap wager: $20/month or $140

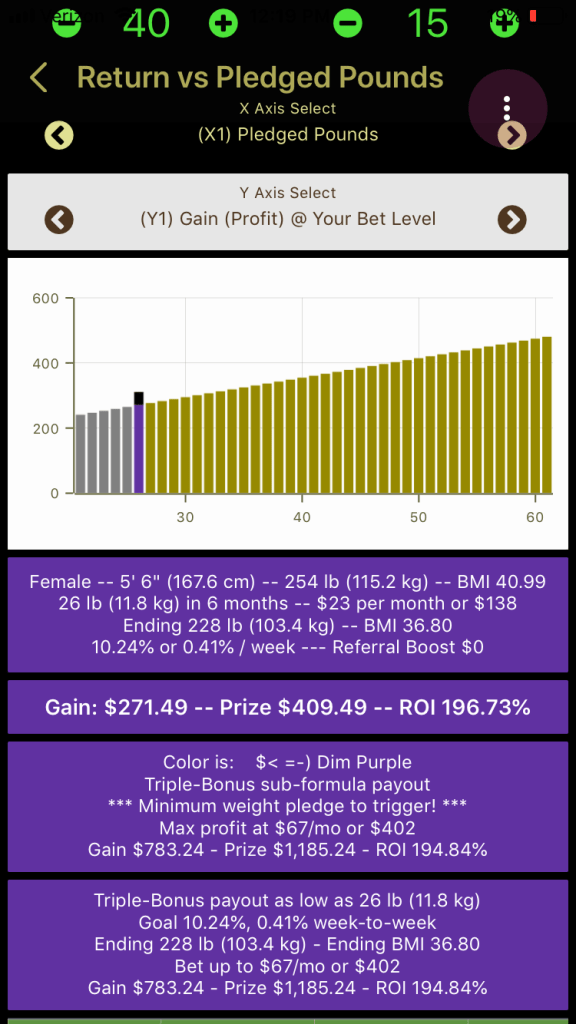

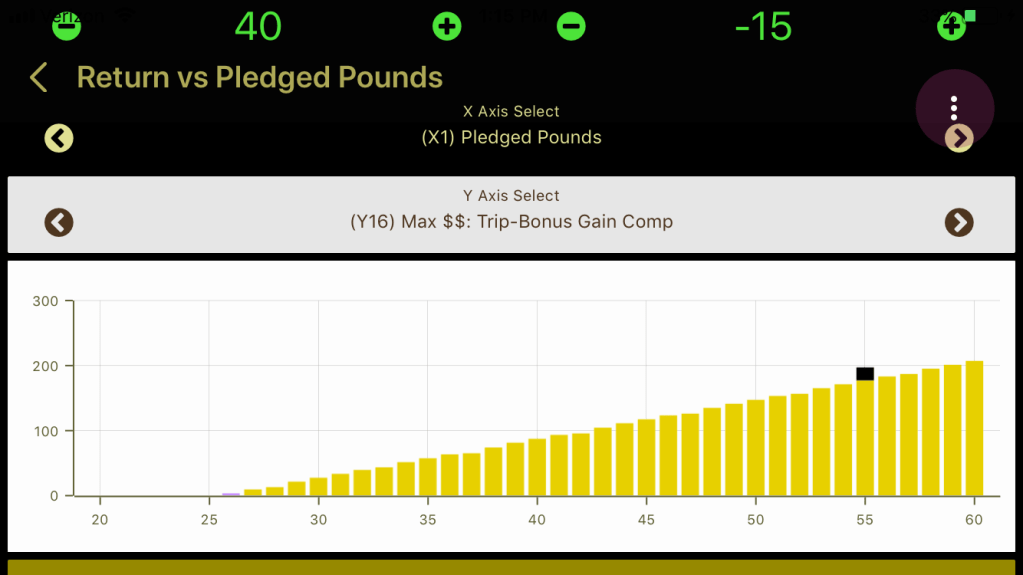

From the Returns vs Pledged Pounds Page:

So it’s more than quadrupling your money for that effort, if you bet only $20/month or $140.

Let’s add a $40 prize boost to it:

Paying about 7:2 odds, or 9-for-2.

I’ll take the $40 boost back out for now, to illustrate some things, and we can add it back at the end.

The graph above shows that you are deep into the Yellow range of pledges. You can see how the profit increases gradually as pounds are added or removed from the wager, in reference to 55 pounds.

In fact, you can make a minimum weight pledge of 26 pounds, which is just over the 10% minimum, and get a profit of $275.37, or 197% ROI. It’s about 70% of the profit available at 55 pounds, which is a much harder pledge over 7 months than 26 pounds. The 55 pound pledge requires 0.80% per week on average, which is fairly brisk. The 26 pound pledge requires only 0.36% per week.

In fact, if you speed up the 26 pound pledge to 6 months and keep the total budget approximately the same:

Not bad money there, and fairly easy to do.

Big money wagers

But let’s assume you really want to make it to Onederland in 7 months. The real financial benefits of going 55 pounds in 7 months occur when you maximize your bet size.

Note in the picture above, it tells you in text that the maximum profit that can be obtained with a 26-lb, 6-month wager is realized when you bet $67/month or $402. If you lose the 26 pounds, you get $783.24 profit.

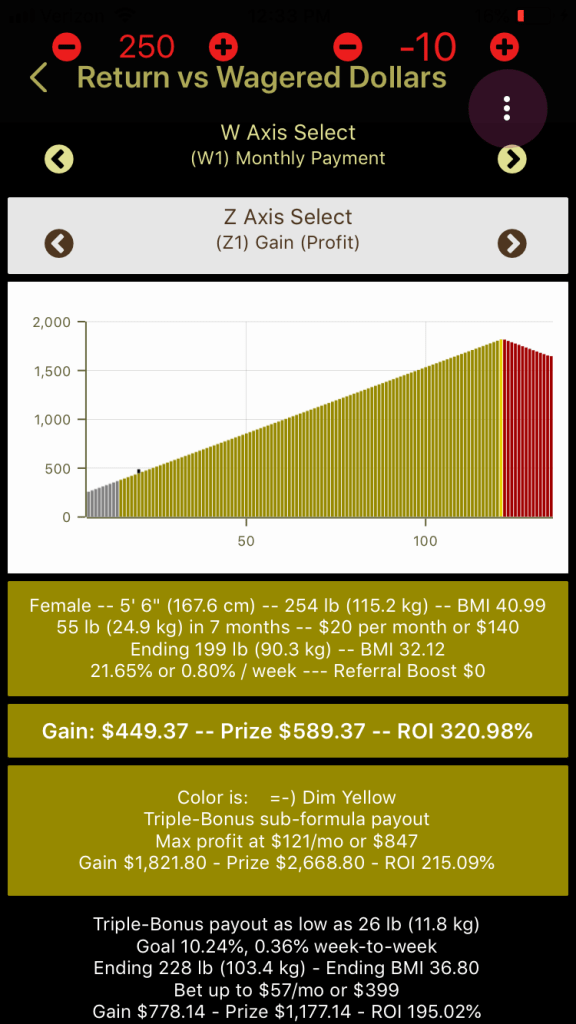

I’ll show you the profit difference on the Return vs Wagered Dollars Page, which has bet size on the horizontal axis (W axis on that page) and prize amount on the vertical axis (Z axis):

If you stay at 26 pounds, and bet more than $402, your profit deteriorates from the $783.24 maximum to $780, and stays there as more money is bet. Other than referral bonuses, Healthy Wage won’t pay you more than $783.24 for a 26-pound wager.

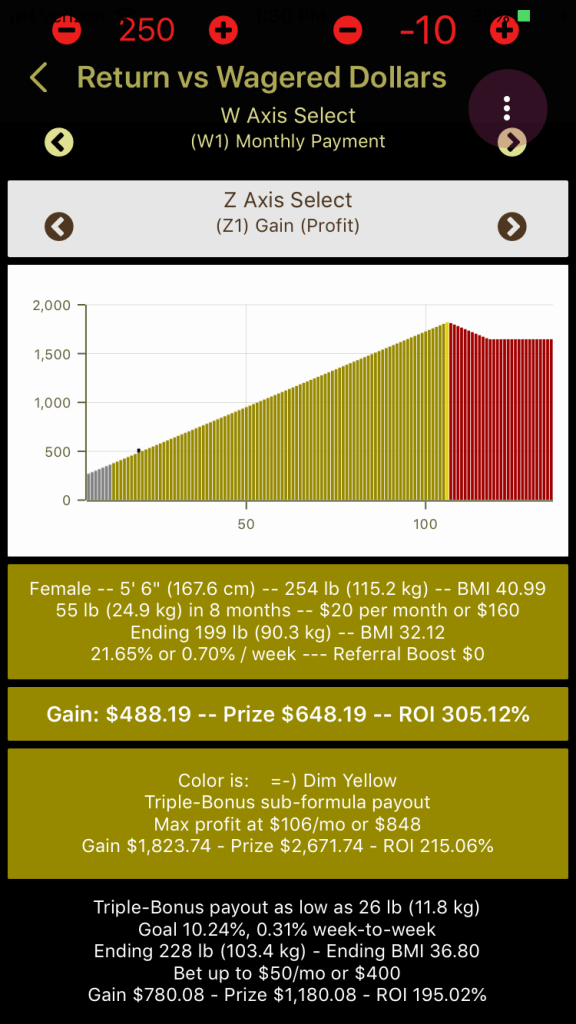

For 55 pounds in 7 months (staying on the Return vs Wagered Dollars Page)

If you keep the $140 budget, in 7 months you’ll earn $449.37.

If you wager $57/month or $399—approximately what you’d wager to max our profit for a 26-pound, 6-month wager—your gain will be $952.14. This is about $170 greater than the $783.24 profit from the easier wager.

But if you go 55 pounds, you can wager as much as $121/month or $847–which you can’t do with a 26-pound pledge without wasting money. With the $847 bet, the profit will be $1,821.80. It’s a lot more profit to shoot for if you are determined to meet a Onederland goal.

Profit opportunity versus pledge

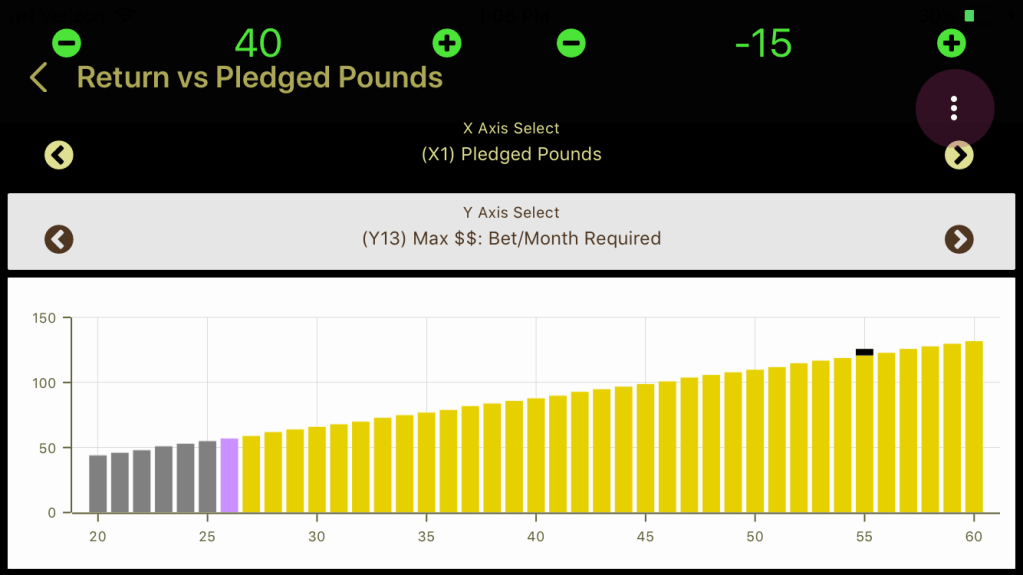

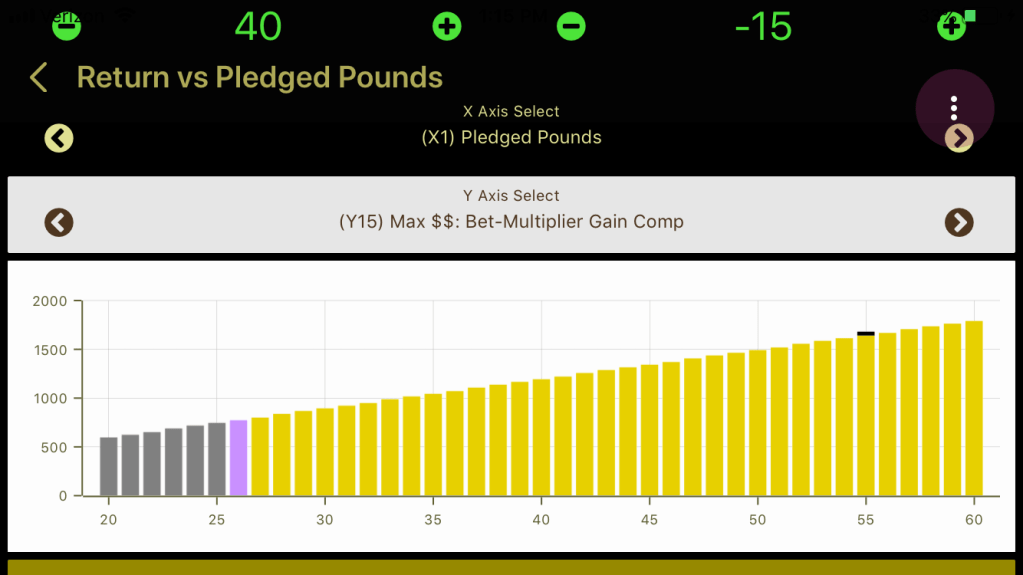

Back on the Return vs Pledged Pounds Page, you can plot the maximum gain attainable across a range of pledges, as well as the bet required to attain them.

You can see from the above that more money can be risked as the pledges get more aggressive. Most of the gain improvement is derived from the additional money bet—you get 194.12% return on every dollar you bet—but there is another $6.00 added for each extra pound.

Slowing it down

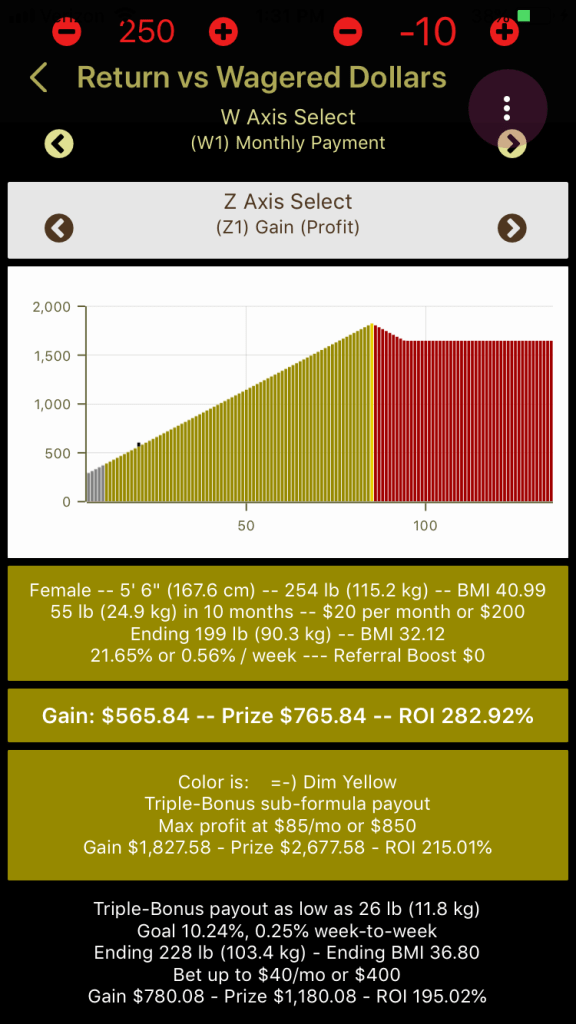

On the other hand, if you are determined to get to Onederland, but you think 7 months is not enough time, you can increase the time of the wager and get about the same profit for the same bet size overall.

Back on the Return vs Wagered Dollars Page:

8 months, 0.70% loss per week:

9 months, 0.62% loss per week:

10 months, 0.55% loss per week:

Maximum profits are all about $1,820, after spreading $850 or so in bet money across the number of months involved.

Note: For these “yellow” and “purple” wagers, which pay out according to the “triple-bonus” sub-formula in the calculator, the profits do not depend on the amount of time required to lose the weight.

But for the “green” wagers, which pay out according to a less generous sub-formula that offers only an ROI on your bet and no pledge-dependent bonus, the ROI goes up slightly as you add more time to the bet. This dependency is so mild that the profit actually goes down when measured on a per-month basis. However, if the ROI for a 6-month “green” wager was around 180-190 percent, you may find that adding months to to the wager will turn it either “purple” or “yellow” and end up getting you a big jump in profit.